- #Jack stamos group ransomwhere 32m pagetechcrunch Patch#

- #Jack stamos group ransomwhere 32m pagetechcrunch series#

#Jack stamos group ransomwhere 32m pagetechcrunch series#

And after a series of cyberattacks against the fuel supplier Colonial Pipeline, everyone is serious about the adverse effects of ransomware.

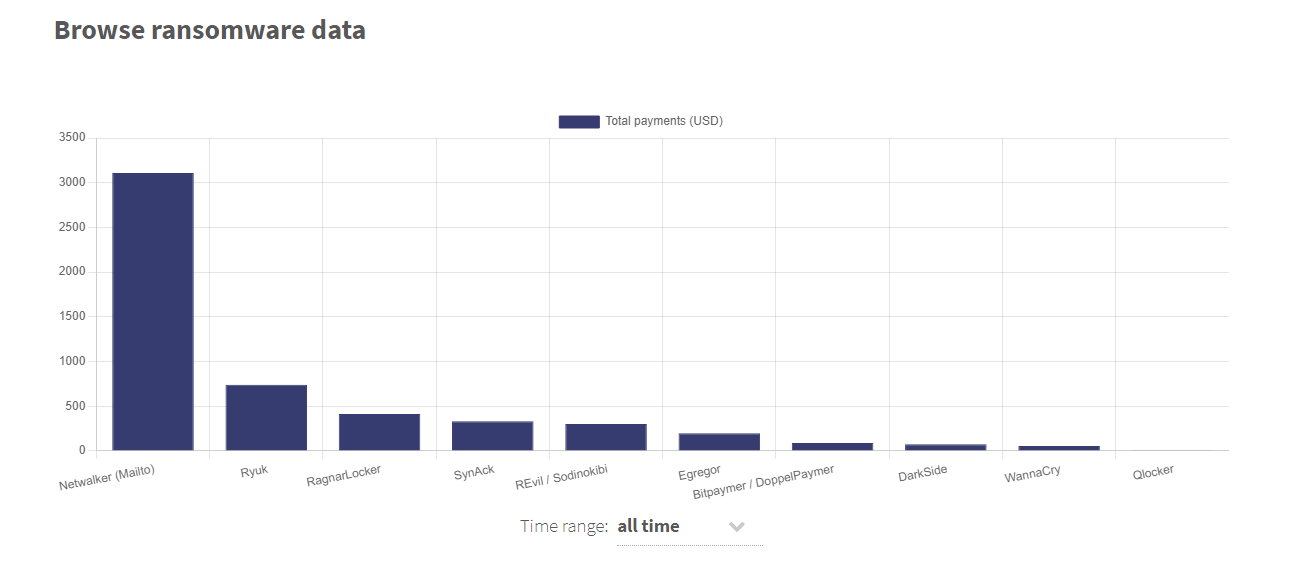

There is no denying that ransomware is a grave issue for the national security of many countries. However, while ransomware attacks continue to make headlines, it’s nearly impossible to. Cable Stamos Group Ransomwhere 32M PageTechCrunch Published: DecemReading time: 2 min. Jack Cable, a security architect at Krebs Stamos Group who previously worked for the U.S. On December 10, 2020, the CFPB released two separate final rules: the first, redefining the General Qualified Mortgage requirements (General QM Rule) and the second, establishing requirements for a new Seasoned QM loan (Seasoned QM Rule). Cybersecurity and Infrastructure Agency (CISA), is looking to solve that problem with the launch of a crowdsourced ransom payments tracking website, Ransomwhere.

#Jack stamos group ransomwhere 32m pagetechcrunch Patch#

#Qm points and fees limits 2020 Patch#Īnother recent final rule provides that the so-called “Temporary GSE Patch QM” will expire on the mandatory effective date of the General QM Rule which is July 1, 2021, or the date the GSEs exit conservatorship, if earlier than July 1.īoth rules will become effective 60 days after they are published in the Federal Register, expected shortly. The major features of the General QM Rule are the elimination and replacement of the requirement that for a General QM, the borrower’s debt-to-income ratio must not exceed 43% based on Appendix Q. The client told me that he received a call from someone in Kansas City. The General QM Rule replaces the DTI and Appendix Q requirements with requirements based on the pricing of the loan. Im actually having the exact issue with a client of mine located in Dallas, TX. Under these requirements, a loan may qualify as a “Safe Harbor QM” if (among other things) its APR is less than 1.5 percentage points above the APOR at the time the interest rate for the loan is set (3.5 percentage points or more for second-lien loans). A loan may qualify as a “Rebuttable Presumption QM” if (among other things) its APR is at 1.5 percentage points but less than 2.25 percentage points above the APOR at the time the interest rate is set. A loan with an APR exceeding the APOR by 2.25 percentage points or more cannot meet the definition of a general QM, unless it has a smaller loan amount subject to higher caps. General QMs still must meet the current restrictions against certain loan features common to most other QM types (such as no negative amortization and or no loan terms exceeding 30 years) and have points and fees no greater than the 3% cap (with higher caps for certain smaller loans). Additionally, lenders are still required to “consider and verify” a borrower’s income, assets, debts, and liabilities when originating a general QM. With the removal of Appendix Q and the 43% debt-to-income ratio limit, however, the CFPB has added substantial official commentary describing how lenders can consider and verify this information.

0 kommentar(er)

0 kommentar(er)